Staying informed about the current gold price is crucial for investors and those interested in precious metals.

The spot price of gold fluctuates constantly due to various market and economic factors. Understanding these fluctuations is essential for making informed investment decisions.

As a valuable resource, this guide provides you with up-to-date data and news on gold prices, helping you navigate the complex world of precious metals.

Key Takeaways

- Understand the current gold price movements and their impact on investments.

- Learn how to track gold prices in real-time.

- Discover various investment options available in the gold market.

- Stay informed with the latest gold price news and data.

- Make informed decisions with our comprehensive guide.

Current Gold Price Trends

As you navigate the complex world of gold trading, staying up-to-date with the latest price trends is essential. The current gold price trends reflect a complex interplay of global economic factors, with recent movements showing significant volatility.

Factors Influencing Today’s Gold Prices

Several key factors are influencing today’s gold prices. These include inflation concerns, with investors closely monitoring Consumer Price Index reports, and central bank policies, which can impact the gold spot price. The strength or weakness of the US dollar also maintains an inverse relationship with gold prices.

- Inflation concerns driving gold price movements

- Central bank policies impacting gold spot prices

- US dollar strength affecting gold prices

Recent Market Movements

Recent market movements have been characterized by significant fluctuations in gold prices. Interest rate decisions by the Federal Reserve have created notable price swings, particularly affecting short-term spot prices. Geopolitical tensions have also contributed to gold’s appeal as a safe-haven asset, pushing prices higher during periods of uncertainty.

- Interest rate decisions impacting gold prices

- Geopolitical tensions driving gold demand

- Technical analysis showing key resistance and support levels

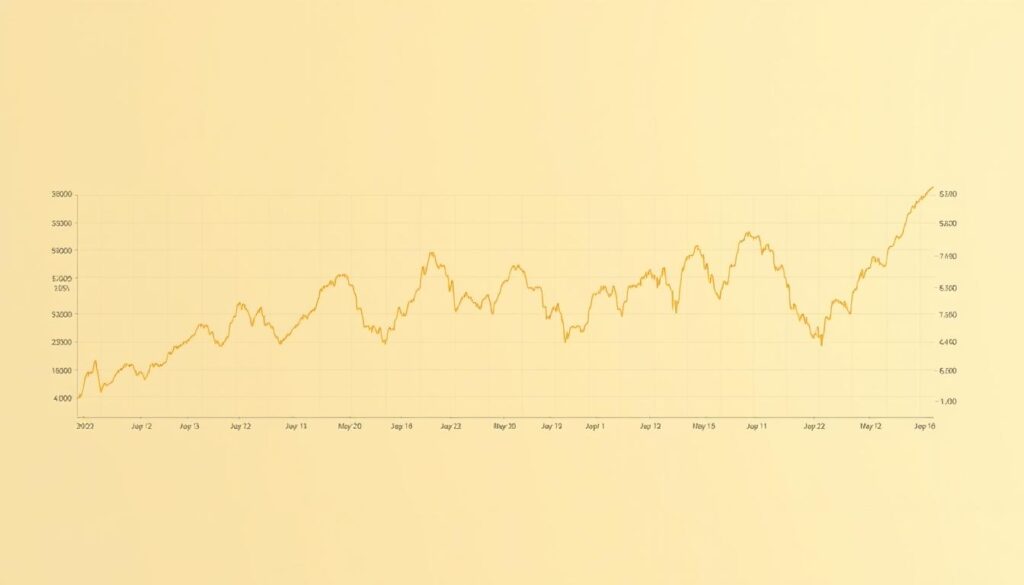

Gold Price Historical Performance

As you explore the historical performance of gold prices, you’ll uncover a complex narrative shaped by economic events and investor behavior. The gold price has been closely followed by investors worldwide.

Gold Price Evolution Since the End of Gold Standard

Since the end of the gold standard in 1971, the price of gold has continued to rise. The US dollar’s convertibility to gold ended, allowing market forces to determine its value. This significant event marked the beginning of a new era for gold, with its price influenced by various economic factors.

Impact of Major Economic Events on Gold Prices

Major economic events have significantly impacted gold prices. For instance, the 1970s oil shocks led to substantial increases in gold prices. The table below highlights some key events and their impact on gold price.

| Economic Event | Year | Impact on Gold Price |

|---|---|---|

| End of Gold Standard | 1971 | Freed from governmental constraints |

| Oil Shocks | 1974 | 60% increase |

| September 11 Attacks | 2001 | Renewed interest in gold as a safe haven |

The history of gold prices provides valuable context for understanding potential future price movements and investment timing. As investors, you can learn from the past to make informed decisions about your investments in gold.

Understanding Gold Price Fluctuations

To navigate the gold market effectively, it’s vital to comprehend the factors that drive gold price fluctuations. The value of gold is influenced by a complex interplay of economic indicators and market sentiments.

Economic Indicators That Affect Gold Prices

Economic indicators play a significant role in shaping gold prices. Key factors include inflation rates, interest rate decisions by central banks, and employment data. For instance, higher interest rates typically put downward pressure on gold prices, while a weaker US dollar makes gold more attractive.

| Economic Indicator | Impact on Gold Price |

|---|---|

| Inflation Rate | Hedge against currency devaluation |

| Interest Rate Decisions | Higher rates: downward pressure |

| Employment Data | Influences market expectations |

Geopolitical Tensions and Market Sentiment

Gold spot prices are also influenced by geopolitical tensions and market sentiment. During conflicts or political instability, investors often turn to gold as a safe-haven asset, driving up its price. Moreover, market sentiment can create momentum-based trading in gold markets.

Gold Price Charts and Analysis Tools

To make informed investment decisions, you need access to reliable gold price charts and analysis tools. These resources provide essential data for tracking spot prices across multiple timeframes and currencies.

Live Gold Price Charts

Live gold price charts offer real-time data, enabling you to track gold price per ounce in USD, EUR, and other currencies. Historical charts provide perspective on price movements over various periods, from 30 days to 39 years.

Available Timeframes and Currencies

You can access gold price information in multiple currencies, including USD, AUD, CAD, and more. The charts also offer various timeframes to suit your investment needs.

Technical Analysis Features

The charts include technical analysis features such as moving averages, Bollinger Bands, and RSI indicators to enhance your trading decisions.

Gold Price Calculators

Investment value calculators allow you to determine the current worth of your gold holdings based on up-to-the-minute spot prices. Additionally, gold conversion tools enable you to translate between different weight measurements, such as ounces to grams or kilos.

Investment Value Calculators

These calculators help you assess the value of your gold investments by comparing your purchase price to current gold spot prices.

Gold Conversion Tools

The conversion tools provide precision in calculating the value of your gold, whether you’re dealing with gold jewelry or bullion.

Popular Gold Investment Options

Investors seeking tangible assets often turn to gold as a reliable store of value. You have several options when it comes to investing in gold, ranging from coins to bars.

Physical Gold Products

Gold coins and bars are popular among investors. You can choose from various products, including:

Gold Coins (American Eagles, Maple Leafs, Krugerrands)

These coins are minted by reputable authorities and offer a convenient way to invest in gold. For instance, American Gold Eagle coins contain one troy ounce of gold with a 22-karat purity (91.67%). Canadian Maple Leaf coins are known for their 99.99% purity (24-karat).

Gold Bars and Bullion

Gold bars and bullion are available in various weights, from 1 gram to 1 kilogram. Larger bars typically command lower premiums over the spot price.

Where to Buy Gold

You can buy gold from online retailers or established bullion exchanges. When purchasing, consider the premiums above the spot price, which cover minting costs and dealer margins.

Online Gold Retailers

Online retailers offer competitive prices and convenient shopping. However, it’s crucial to vet them to ensure authenticity and fair pricing.

Delivery Timeframes and Considerations

Delivery times can range from immediate pickup to 5-8 weeks for special orders. Be aware that additional delays may occur with check payments.

Mobile Applications for Tracking Gold Prices

![]()

Mobile gold price tracking apps have revolutionized the way investors make informed decisions. These apps provide real-time data access anywhere and anytime, allowing you to stay updated on the latest gold prices.

iOS Gold Price Apps

iOS gold price apps offer seamless integration with Apple’s ecosystem, enabling you to monitor gold price per ounce in USD and other currencies directly from your iPhone or iPad.

Features and Benefits

Premium iOS apps feature customizable price alerts that notify you when gold reaches your target buy or sell price points. Many iOS gold apps include historical price charts with multiple timeframes.

User Experience

The user experience on iOS gold tracking apps typically emphasizes clean design and intuitive navigation, with most offering both free versions with ads and premium ad-free options.

Android Gold Price Apps

Android gold price apps provide similar functionality to their iOS counterparts but often with more customization options and widget capabilities for your home screen.

Features and Benefits

Leading Android gold tracking applications integrate with major exchanges, providing real-time spot prices for gold, silver, and other precious metals. Both iOS and Android platforms offer apps that include gold gram calculators.

User Experience

The user experience on Android platforms varies more widely than iOS, with some apps focusing on technical analysis tools while others emphasize news and fundamental data.

Conclusion: Making Informed Gold Investment Decisions

As you navigate the complex world of gold investments, understanding current and historical gold prices is crucial. To make informed decisions, consider diversifying your investments across different forms of gold, such as physical bullion and coins, as well as ETFs and mining stocks. Timing your entry points by monitoring gold price charts can improve long-term returns. Stay informed about global economic news and factor in all costs associated with gold ownership. By doing so, you’ll be better equipped to navigate the markets and make informed investment decisions.